The Ultimate Guide To Outsourced Cfo Services

Table of ContentsThe 2-Minute Rule for Pivot Advantage Accounting And Advisory Inc. In VancouverNot known Facts About Vancouver Tax Accounting CompanyFacts About Small Business Accounting Service In Vancouver UncoveredThe Definitive Guide for Pivot Advantage Accounting And Advisory Inc. In VancouverWhat Does Outsourced Cfo Services Do?The Ultimate Guide To Vancouver Tax Accounting Company

Below are some benefits to working with an accountant over a bookkeeper: An accountant can provide you a detailed sight of your service's economic state, in addition to methods and also recommendations for making monetary decisions. At the same time, accountants are just in charge of recording financial purchases. Accountants are required to finish more schooling, certifications and job experience than accountants.

It can be tough to assess the suitable time to hire an audit professional or accountant or to figure out if you need one in any way. While several small companies employ an accountant as a specialist, you have a number of choices for taking care of monetary jobs. For example, some local business proprietors do their own bookkeeping on software application their accountant recommends or uses, giving it to the accountant on a regular, regular monthly or quarterly basis for action.

It may take some history research to locate an ideal bookkeeper because, unlike accounting professionals, they are not needed to hold a professional certification. A strong endorsement from a trusted associate or years of experience are essential factors when working with an accountant.

Fascination About Virtual Cfo In Vancouver

For small companies, proficient money management is a crucial aspect of survival and growth, so it's smart to deal with a financial specialist from the beginning. If you choose to go it alone, think about beginning with bookkeeping software application and maintaining your books carefully approximately date. By doing this, must you require to work with a specialist down the line, they will certainly have visibility into the complete monetary history of your service.

Some resource meetings were performed for a previous variation of this article.

Excitement About Small Business Accountant Vancouver

When it involves the ins as well as outs of taxes, bookkeeping as well as financing, nonetheless, it never ever hurts to have a knowledgeable professional to look to for support. An expanding number of accountants are likewise looking after points such as capital forecasts, invoicing and also HR. Eventually, much of them are handling CFO-like duties.

Small company proprietors can expect their accounting professionals to aid with: Selecting business structure that's right for you is essential. It affects just how much you pay in tax obligations, the documents you require to file and your personal liability. If you're looking to convert to a different company framework, it could result in tax consequences and other difficulties.

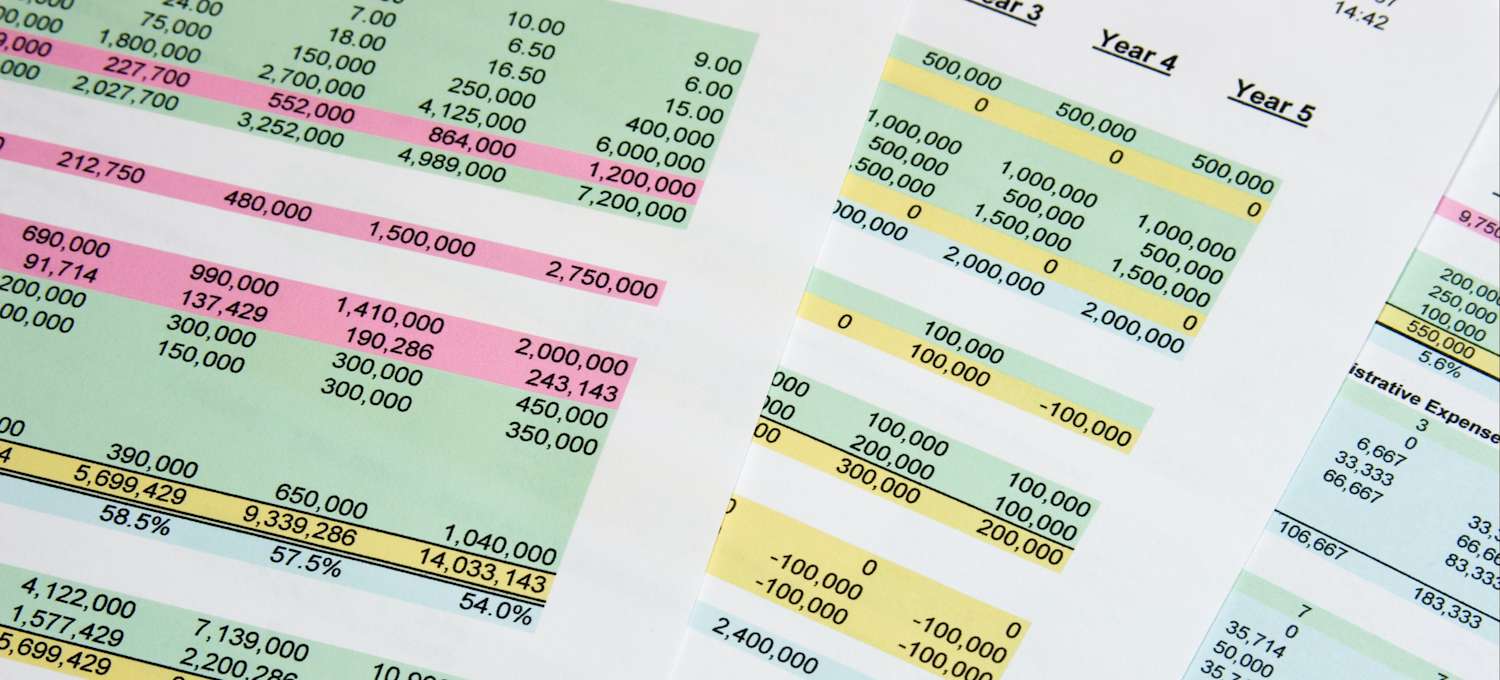

Even companies that are the very same size and also industry pay very various amounts for accountancy. Before we enter dollar numbers, let's talk concerning the costs that go into tiny company accountancy. Overhead expenditures are prices that do not directly transform into a revenue. These costs do not transform into cash, they are necessary for running your service.

The Best Guide To Small Business Accounting Service In Vancouver

The typical expense of accounting services for tiny business differs for every special scenario. Considering that accountants do less-involved tasks, their prices are typically less expensive than accounting professionals. Your financial service charge depends on the explanation work you require to be done. The ordinary monthly accountancy fees for a small organization will increase directory as you add extra services and the jobs obtain harder.

You can videotape deals and procedure payroll using online software. Software solutions come in all shapes and sizes.

The Ultimate Guide To Vancouver Tax Accounting Company

If you're a brand-new local business owner, do not fail to remember to variable bookkeeping expenses right into your budget. If you're an expert proprietor, it could be time to re-evaluate accountancy prices. Administrative costs as well as accountant charges aren't the only audit expenses. Vancouver tax accounting company. You ought to also consider the effects bookkeeping will have on you and your time.

Your ability to lead workers, offer clients, as well as make decisions can endure. Your time is additionally the original source valuable and must be taken into consideration when considering accounting costs. The time invested on accountancy jobs does not create earnings. The much less time you invest in accounting and taxes, the even more time you need to expand your service.

This is not planned as lawful suggestions; for more information, please go here..

Rumored Buzz on Vancouver Tax Accounting Company